BY:

A solution to improved credit availability for smallholders and MSMEs in Kenya

November 24th, 2025

Many smallholders and Micro, Small and Medium Enterprises (MSMEs) do not have sufficient collateral for a lender to extend credit against (fixed assets, including equipment and property) despite a good number of them having incomes and business cash flows, that ideally, demonstrate their ability to repay a loan obligation.

FSD Kenya’s continuing collaboration with Hello Tractor is now revealing that an accurate farmers disposable income estimate is of predictive importance and incredibly useful in credit and underwriting. Therefore, financial institutions should make increased use of documented cash flow as a basis for underwriting loans and extending credit to MSMEs and smallholder farmers. The use of payment platforms by MSMEs and smallholder farmers, including mobile money, allows financial institutions the ability to determine if a borrower has adequate net cash flow (inflows minus outflows) to repay a loan It is likely that loans that are based on the borrower having sufficient cash flow to repay an obligation are less likely to default, because the borrower is subjected to the more detailed credit procedures necessary to document that the borrower has the cash flow necessary to repay the loan.

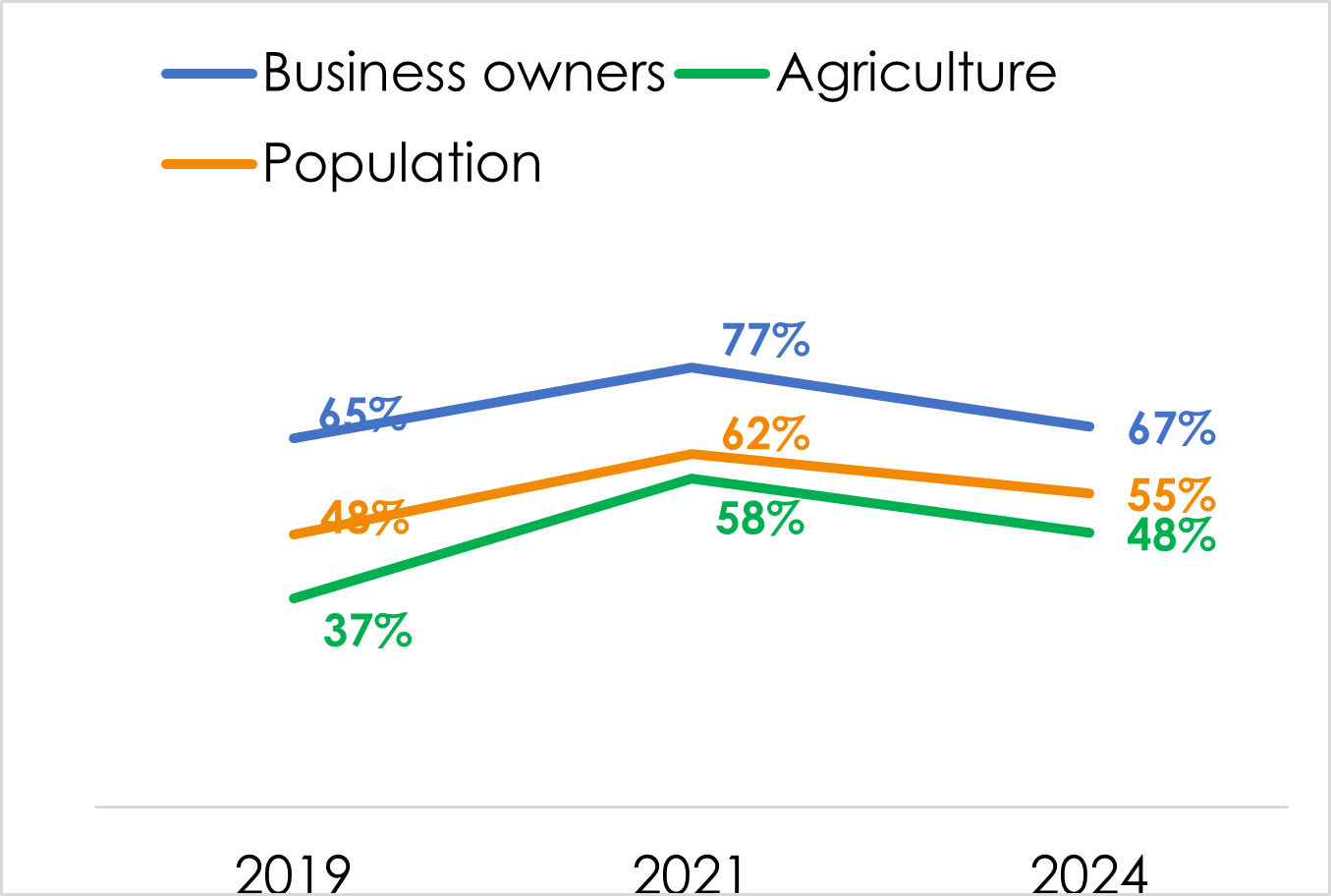

Currently, availability of cash flow credit is limited by requirements by lenders that borrowers produce financial statements, or requirements that borrowers have a formal banking relationship in the form of checking or savings accounts. From FinAccess 2024, more than two thirds of micro and small enterprises and about a half of smallholders now use mobile money for savings or credit (67% vs 48%%) compared to 2019 (65% vs 37%) and 2021 (77% vs 58%) (See figure 1 below). Coupled with the understanding that MSMEs have neither a significant formal financial statement nor a banking relationship, cashflow lending offers the greatest potential for greater smallhholder approval and inclusive and sustaiable livelihoods

Figure 1. Mobile savings/credit usage in Kenya (2019-2024)

Presently, there are improved conditions that should allow cash flow loans to become more available because of the increased use of payment systems, including M-Pesa, Fuliza, Mshwari in Kenya, on which lenders can use to determine if a borrower has sufficient cash flow to repay a loan through careful review of mobile money statements, including M-Pesa statements, showing cash inflows and outflows.

What is cash flow lending

Cash flow lending is based on the ability of a borrower to repay a loan extended by a financial institution (the lender) out of its business cash flow. In its simplest form, “cash flow” is defined as the amount of cash moving through a business on a regular basis. For purposes of extending credit, cash flow for a prospective borrower is documented through publicly available platforms, such as MPESA, provided directly to the lender. Cash flow is considered the primary source of repayment for the obligation. For purposes of making a decision to extend credit, the value of the collateral pledged by the borrower to the lender to secure the loan is worth zero.

The goal is to leverage available and historical financial cash flow at its most granular level, to determine borrowers’ probability of default.

Cash flow lending is different from what is normally referred to as “secured lending,” a form of credit extension that is largely based upon the value of collateral owned or possessed by the borrower, normally described in a movable asset registry, that is further described as a “security right” pledged by the borrower in favor of a lender as part of a loan transaction. CBK defines fully secured lending as a “credit facility where collateral used to secure the facility has a value that is sufficient to cover the carrying amount of the loan. Such security is perfected in all respects and has no prior encumbrances that could impair its value or otherwise prevent obtaining clear title[1]”.

Benefits of cash flow lending

Cash flow lending has the following benefits:

- Improves access by showcasing enhanced predictability upfilft: Since credit approvals for loans primarily based on the borrower’s documented ability to repay the loan is dependent of the lender documenting the ability of the borrower’s ability to repay the loan, borrowers that have fewer fixed assets, such as machinery and equipment, become more likely to become an eligible borrower, provided that they have sufficient documented cash flow to repay the obligation.

- Less reliance on collateral as a repayment source: A borrower with credit extended under a secured loan, with little or no reliance on the ability of a borrower repay the loan, has a greater risk of a loan default where the lender would take physical possession of the collateral.

However, successful extension of lending based on the ability of a borrower to repay a loan depends on the lender being able to establish that the borrower has sufficient cash flow to service the loan. The lender, by thorough analysis of the borrower’s financial information, determines to its satisfaction that the borrower can repay the loan within terms. This requires that the lender has a credit department that contains personnel capable of accurately analysing the ability of a potential borrower to repay the loan as agreed.

However, improved availability of cash flow loans depends on the following four factors:

- The willingness of lenders to use statements generated electronic payment systems like M-Pesa or proxy agri-income estimates for thin-file segments, as a basis to determine a borrower’s ability to repay an obligation.

- Ability of lenders to adopt credit underwriting procedures that are both accurate and comprehensive and can be performed at minimal cost.

- Ability of lenders to develop loan products that are both attractive to the borrower and contain credit underwriting policies necessary to satisfy the lender that the borrower can repay the obligation.

- Regulators have requirements that place more emphasis on the borrower’s ability to repay, rather than requiring lenders to retain what amounts to over-collateralisation of business loans.

In collaboration with Hello Tractor, FSD Kenya is currently undertaking a pilot project designed to improve the availability of credit for smallholder farmers in the maize value chain, through extending post-harvest loans with a double warehouse certificate as collateral. Credit approval is based not on the value of the collateral that is described in the warehouse receipt pledged to the lender, but on the ability of the borrower to repay the obligation, independent of the value of the collateral. For purposes of credit evaluation, the value of the collateral pledged by the borrower is worth zero. Additional underwriting conditions include spousal consent, whereby the spouse of the borrower attests his or her consent to the borrower taking out the loan.

This has proven useful to underwrite credit for thin files segments in Kenya even with little or no experience in credit an underwriting. In a pilot warehouse receipt finance project with FSD Kenya, Hello Tractor has managed to extend a small number of short-term (less than 13 months), post-harvest loans with a term of up to six months and secured by a double warehouse certificate. Repayment has been 100%. This way, market failures often characterized by information asymmetry where credit providers often have limited information on new borrowers’ characteristics such as past borrowing and repayment behavior that would be an indication of repayment risk, is surmounted.

In achieving these objectives, the Hello Tractor Project has the potential of expanding the availability of commercial credit, including factoring, financial leasing, and post-harvest financing, to the smallest businesses, and do it in a manner that is consistent with a lender’s credit requirements.

In other words, the Hello Tractor Project aims to apply the original principles contained in secured lending to the smallest businesses, specifically:

- Establishing the ability of the smallest borrowers to service a loan using cash flow as the primary source of repayment:

- That it is possible for a lender to successfully evaluate and underwrite a loan using financial data generated by digital payment channels such as mobile money accounts e.g., MPesa, Mobile Money Business Wallet (g. Pochi la biashara), Merchant / business pay bill /Till Number etc.

Through the results of the pilot project, it is hoped that access to all types of commercial loans will improve throughout Kenya and, furthermore, that other countries will benefit from the pilot project’s results.

Recent developments affecting the growth of commercial lending in Africa

Over the last 10 – 15 years, several countries in Africa have enacted legislation leading to the establishment of Movable Assets Registries[2]. Movable asset registries are now operational in several African countries, including Kenya, Tanzania, Ethiopia, Liberia, Ghana, Zambia, and Rwanda. This has led directly to the growth of secured lending[3].

While it is commonly understood that the primary source of repayment on a secured loan is the business operations generated by the borrower, known as cash flow, rather than the pledged collateral, virtually all secured lending in Africa now requires a borrower to pledge collateral to the lender. This is mostly in the form of a security right, as additional assurance that the borrower will repay the loan and is considered as a secondary source of repayment, used only If a borrower defaults on a loan and likely only as partial repayment of the loan’s principal balance.

The increased preference for collateral over cash flow in secured lending

In recent years, reliance on the value of pledged collateral has inadvertently taken precedence as a primary source of repayment for commercial loans, even though the operation(s) of the borrower’s business is the primary source of repayment. In a knowledge guide published in 2018, it would be easy to conclude that cash flow played little or no role in the ability of an MSE to obtain credit as opposed to inadequate cash flow, which is the right metric. A common trend therein for MSMEs, accounting for almost 50% of applicants, was that credit applications were rejected mostly due to insufficient or unacceptable collateral. Interestingly, inadequate cash flow sufficient to repay the obligation was not mentioned as a major (or otherwise) reason why a loan application was rejected.

Based on our observations, there is inadequate capacity and expertise to develop and provide credit solutions that are responsive to demand side needs. This is especially acute among credit officers to the smallest borrowers that are credit invisible due to a lack of banking relationship or lack supplier references that offer them credit. As such, an inability to evaluate and underwrite smaller borrowers that operate in the in the informal, cash-based economy, means that financial institutions revert to collateral as, in effect, the primary source of repayment, which is misguided.

The lack of capacity, and expertise to develop credit solutions, often encourage financial regulators to prescribe capital requirements for loans smaller businesses, including collateral whose value often exceeds the amount of the loan. The results are often the following:

- Reduce the volume of lending in an economy, especially among the smallest businesses, simply because most of the smallest businesses don’t have sufficient collateral to qualify for a loan.

- Increases the probability of default, in situations where lenders simply don’t consider a borrower’s ability to repay and instead rely solely on the value of the pledged collateral.

- Discriminates against businesses of all sizes that do not require a high-level of collateral to operate, but at the same time may have sufficient cash flow to service a loan.

Also, interventions by most (international) development finance institutions often stop at assistance to governments to develop necessary legal and regulatory frameworks to improve the potential for increased volume of credit. This a necessary but not sufficient condition. Without loan products that are attractive to potential borrowers, supported by lenders with strong credit and underwriting skills, the return on the funds spent by development finance institutions for the purpose of improving legal and regulatory conditions to improve access to finance for MSMEs and smallholder farmers send up being very low. To get the best returns on money spent on legal and regulatory improvements, it is necessary for development finance institutions to ensure that financial institutions have both attractive loan products and credit and underwriting skills that will allow them to extend credit to smallholder farmers and MSME.

Are there examples we can learn from?

An analysis of the Movable Asset Regulatory System in Zambia describes the performance of Zambia’s movable asset-based registry, and it sheds light on this problem:

- Registrations with the Movable Property Registration System (MPRS) have largely failed to cover key segments, including rural populations, MSMEs, and women-owned businesses. The registrations were also primarily performed in urban areas. Rural areas represented only 10% of registrations, which is probably a reflection of the fact that branches of financial institutions, and a significant share of their portfolios, are concentrated in urban areas.”

- The total value of loans in 2019 was more than USD 588 million, up from USD 353 million in 2016. The average value of loans has also increased from USD 10,000 in 2016 to USD 15,000 in 2019.”

Taken together, the conclusions from this study suggest that this movable collateral registration system is not inducing financial institutions within the country to offer credit extensions to the smallest businesses and smallholder farmers. In addition to a small footprint in rural areas, the reason may be a combination of lack of collateral among the smallest businesses that disqualifies them from obtaining credit, and the limited ability of local financial institutions to underwrite and evaluate the ability of the smallest borrowers to service loans.

An Important objective of the Hello Tractor Project is to establish, through the use of electronic payment systems and careful and through credit analysis based on the prospective borrower’s cash flow, rather than collateral value, that it is possible not to repeat the experience, aforementioned, and at the same time leverage the legal and regulatory precedence described above, to offer commercial credit extensions to the smallest businesses.

Hello Tractor, with FSD’s support, has been developing a finance solution tailored to the needs of smallholder farmers, along with a digital credit and underwriting platform to efficiently and profitably assess the credit of smallholder farmers that emphasizes borrower cash flow as the primary source of repayment. In conclusion, the type of intervention from which both FSD Kenya, Hello Tractor and smallholder farmers are implementing could be applied to financial institutions by other international development institutions, in instances where the objective is to increase credit extensions to MSMEs and smallholder farmers.

[1] CBK, Prudential guidelines, 2013

[2] A movable asset registry allows a potential borrower to create a “security right” in an asset that they either own or possess including, for example, a leased asset. The security right may then be assigned by a borrower to a lender, in consideration for the lender extending commercial credit to a borrower. When the security right is registered in a movable asset registry, the registration becomes public information available to any entity who are authorized to access information contained in the registry.

[3] a type of loan that requires you to pledge an asset as collateral. If you default, the lender can seize the collateral to recoup their losses. This lowers the lender’s risk, allowing it to extend secured loans at lower interest rates and to borrowers it wouldn’t otherwise approve