BY:

Unlocking the power of remittances for women entrepreneurs in Kenya

June 18th, 2025

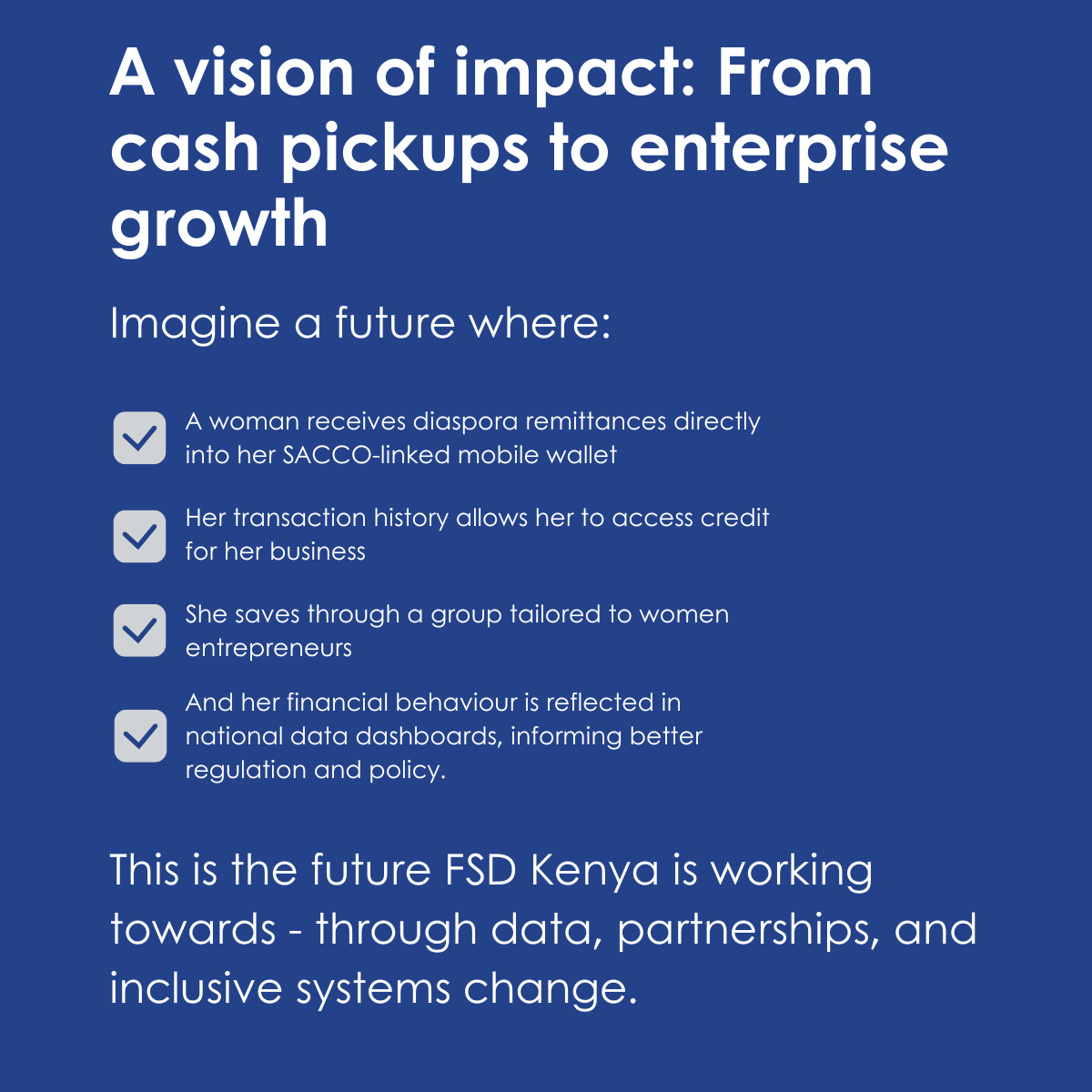

At Financial Sector Deepening (FSD) Kenya, our vision is a financial system that delivers value for all—particularly for low-income households, women, and micro and small enterprises (MSEs). As we commemorate the International Day of Family Remittances (IDFR), we reflect on the important journey FSD Kenya has taken to better understand and unlock the potential of remittances as a tool for inclusive finance and enterprise growth—especially for Women Micro, Small and Medium Enterprises (WMSMEs).

Thanks to support from the International Fund for Agricultural Development (IFAD) through its Financing Facility for Remittances (FFR), FSD Kenya was able to enter the remittance space to explore how these flows could do more than support consumption. There is a powerful opportunity to connect remittances, SACCOs, and sex disaggregated data into a more resilient financial ecosystem that works better for women entrepreneurs and underserved communities. This aligns with FSD Kenya’s recent involvement in championing the provision, sharing and use of sex disaggregated data for MSMEs and co-ordinating the The Women Entrepreneurs Finance Code (the WE Finance Code or, simply, the Code) in Kenya.

SACCOs: A strong partner in inclusive remittance finance

SACCOs are embedded in communities across Kenya and have long been trusted by informal workers and microenterprises. Yet, until now, they have played a marginal role in Kenya’s growing remittance market. The FSD Kenya 2024 study – The role of SACCOs as international remittance providers in Kenya – conducted in partnership with SASRA and IFAD, explored the potential for SACCOs to provide remittance services. The study found strong demand but identified key barriers, including regulatory constraints, high-cost third-party partnerships, and limited product innovation for diaspora, rural households and women-led MSMEs. Two strategies were proposed: strengthening existing partnerships and leveraging a shared SACCO services platform—now being piloted—to enable direct, efficient participation in cross-border remittances. This shared platform opens doors for SACCOs to serve women and rural households with more tailored, accessible financial solutions. In addition, the lessons from this study will inform the development of a tool kit that can support SACCOs to better participate in the remittances space.

Seeing women in the data: An opportunity for more inclusive financial solutions for WMSMEs

While infrastructure is crucial, lasting change is driven by the ability to design solutions based on real user needs—and for that, we need data. Specifically, sex-disaggregated supply-side data that reveals how men and women engage with financial services and where the gaps lie. FSD Kenya, in collaboration with SASRA, is supporting the upcoming 2025 SACCO Demographic Survey—a landmark opportunity to collect detailed, actionable data on SACCO usage by women-led MSMEs and remittance flows, among other key indicators, build dashboards to track gendered financial inclusion over time, and equip SACCOs and stakeholders with the insights needed to design targeted financial solutions. This work positions data not just as a reporting tool, but as a core driver of innovation, inclusion, and accountability.

The 2025 Remittances Household Survey (RHS): A national lens on remittances, gender and finance

FSD Kenya is partnering with KNBS, CBK, and the State Department for Diaspora Affairs on the 2025 Remittances Household Survey (RHS)—a national baseline study that will, for the first time, provide representative and disaggregated data on how remittances are sent and received, the gender, employment, and enterprise status of both senders and recipients, how remittances are used (such as for education, business, health, or savings), and the barriers and costs faced in accessing them. This comprehensive survey will offer important insights into how remittance flows support women’s enterprise development, paving the way for designing financial solutions that move remittances beyond household support toward economic empowerment for women-led MSMEs. IFAD is also supporting aspects of the study.

What’s Next: A call to collaborate

FSD Kenya will continue to explore opportunities with SASRA, KNBS, CBK, IFAD and other partners to support SACCOs to be more equipped to play an active role in remittances, promote more disaggregated data collection, especially sex disaggregated data, to become standard practice across the financial sector, and remittances evolve from short-term lifelines into long-term enablers of growth for women-led MSMEs. These partnerships include the The WE Finance Code collaboration, and we look forward to sharing more on the WE Finance Code, in future blogs.

Final Reflection

The IDFR reminds us that remittances are more than money. They are expressions of trust, sacrifice, and possibility. To honour that, we must build systems that turn those flows into lasting opportunity—especially for women entrepreneurs shaping our economy from the ground up.

When women are visible in the data, they become viable in the market. And when we count women, we make women count.