BY:

Credit denied: What four million loan rejections reveal about Kenya’s financial divide

November 3rd, 2025

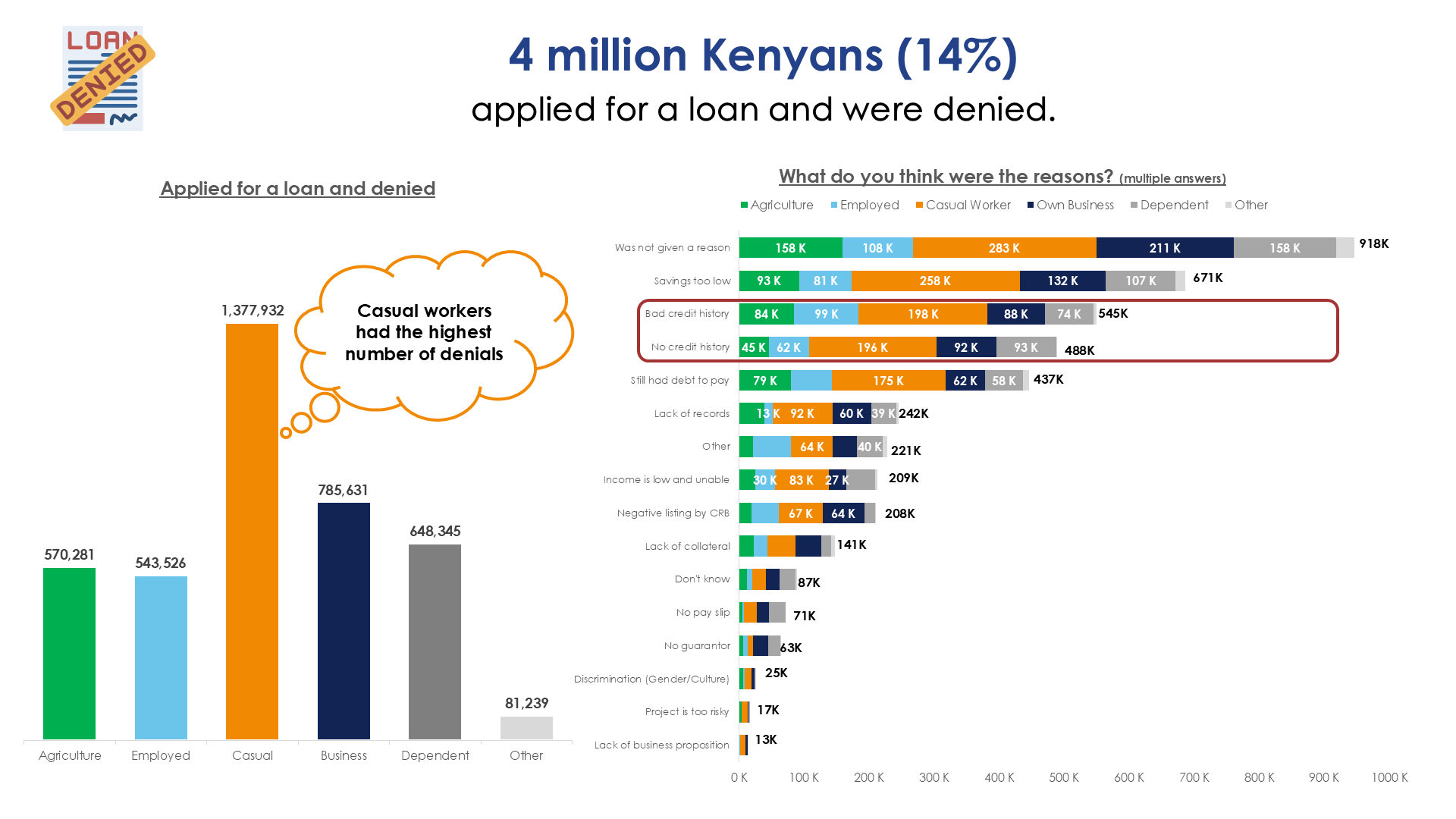

According to the 2024 FinAccess Household Survey, four million Kenyans (roughly 14% of the population) applied for loans but were denied, demonstrating a systemic challenge in Kenya’s financial landscape.

Casual workers, who often face irregular income and limited financial documentation, accounted for 1.38 million of these rejections. This group includes construction workers between jobs, domestic workers paid inconsistently, and seasonal agricultural labourers, who have real incomes, but incomes that don’t fit the mould preferred by traditional lenders.

Nearly 488,000 applicants were rejected due to lack of credit history, yet one cannot build a credit history without first accessing credit. Another 671,000 were turned away for having “savings too low,” a criterion that does not account for the economic realities of those earning KES 300 – 1,000 per day, where every shilling is allocated to essentials before it’s earned.

These insights reveal the quiet determination of millions striving for a better life. Each loan denial represents a Kenyan who dared to believe in their own reliability and viewed credit as a bridge to opportunity. The issue is not whether these four million people deserve credit, but whether the financial system is adapting fast enough to meet them where they are. Building an inclusive economy will require lending models that treat irregular income as normal, open doors for first-time borrowers, and separate low savings from low creditworthiness. Only then can the financial system better serve those who need it most.